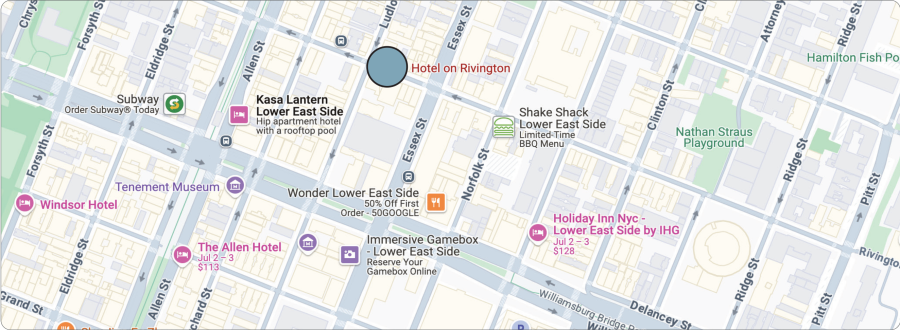

Hotel on Rivington

Investment Highlights and Insight:

Operational Excellence

Income Generation

Institutional Management

Performance Metrics

Targeted

Investor IRR:

10.14%*

Targeted Average

Cash Yield:

7.57%*

Liquidity

Secondary Market

Targeted Equity Multiple:

1.54x*

Price Per Token

$1

Target Period

0 Years

FEATURED PROPERTIES

LOCATIONS

Property Location

TEAM

Ed Nwokedi

Ed is the Founder and CEO of RedSwan CRE Marketplace (“RedSwan”). RedSwan is a leading commercial real estate platform for asset-backed securities, with over $9 billion in tokenized real estate assets. The platform is registered by the SEC and FINRA through its broker-dealer entity, RedSwan Markets, enabling legal issuance, sale, and trade of digital securities of commercial real estate shares.

Ed’s 23-year real estate journey includes tenure at Colliers International and Cushman and Wakefield, Texas, where he rose to Executive Director of Capital Markets, culminating in more than $2.7 billion in multifamily sales. He holds an M.B.A. from St. Mary’s College of California and a B.S. in Accounting and Organizational Behavior from the University of Michigan. Ed is also on the advisory board of the Bauer Real Estate Program at the University of Houston’s C.T. Bauer College of Business.

Martha Theus

Martha brings over 40 years of experience in financial accounting, internal control, and compliance. She has held significant auditing roles, including working at Ernst & Young and serving as Corporate Internal Audit Manager at Lockheed Martin Corporation.

In the early 2000s, Martha transitioned to private practice, honing her expertise in real estate syndication, private placements, investor due diligence, cap table management for both sponsors and investors, and comprehensive financial and tax reporting. She has also been instrumental in implementing investment management software to ensure regulatory compliance with investor standards.

Martha graduated from the University of Michigan with a concentration in Accounting. She is a licensed CPA in California and holds FINRA Series 7, 14, 24, 27, 66 and 79 licenses.

Project Sponsor

Ticker Symbol:

Investment Opportunity

support@redswan.io