Africa Fund

We are excited to introduce our groundbreaking projects: building eco-friendly student housing across Africa to meet the demand of rapidly growing student population. Our mission is to create a sustainable living environment for students, promoting academic success and fostering a positive impact on the community.

While our state-of-the-art sustainable office building is designed to be an oasis of productivity and innovation. Strategically located near top universities in Africa, it offers a world-class hubs for outsourcing jobs and tech opportunities. Targeting over 6,000beds during the pilot phase and 100,000 beds across Africa within the next decade. Revenue is generated through rental income, ensuring investor returns and liquidity via tradable tokens. The fund seeks to combine real estate innovation with social and economic impact, providing scalable solutions for housing deficits in Africa.

Investment Highlights and Insight:

Institutional Management

What Are We Targeting?

Strategy

GP Operators and 3rd Party Managers

Diversification

Income Generation

Performance Metrics

Targeted

Investor IRR:

28.5%*

Targeted Average

Cash Yield:

13%*

Liquidity

Secondary Market

Targeted Equity Multiple:

2.3x*

Price Per Token

$1

Target Period

5 Years

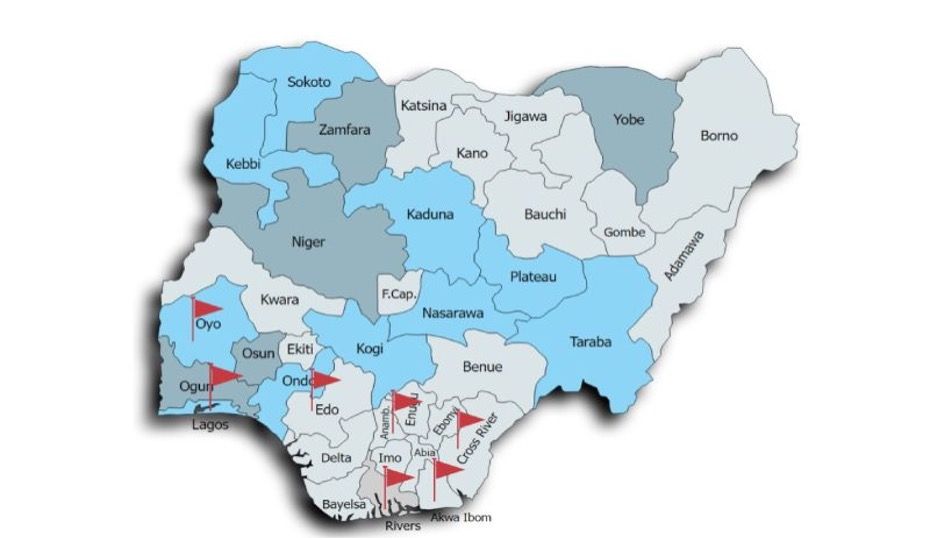

SUBMARKET INSIGHTS OF THE SELECTED LOCATIONS:

Lagos: As the commercial capital of Nigeria, Lagos boasts a high demand for student housing. Its strategic location and economic significance make it a prime target for investment.

Ibadan: Home to Nigeria’s oldest university, Ibadan has a thriving student population and a robust demand for quality housing. The city’s historical significance and educational prestige make it a lucrative investment destination.

Port Harcourt: the capital of Rivers State, is an economic powerhouse in the Niger Delta region, particularly known for its oil and gas industry.

Awka: The capital city of Anambra State in southeastern Nigeria, is a growing urban center with a dynamic economy driven by trade, manufacturing, education, and government activities.

Calabar: the capital of Cross River State, has a unique economic landscape influenced by tourism, agriculture, and trade.

Benin: the capital of Edo State, has a dynamic economy driven by trade, manufacturing, and cultural heritage.

Uyo: the capital city of Akwa Ibom State, is an emerging economic hub in the Niger Delta region. Its economy is driven by oil and gas, agriculture, real estate, and public sector employment.

FEATURED PROPERTIES AND PROJECTS

Student Housing, Tech Hub & Job Centre

TARGET OCCUPANTS

- Under graduates

- Graduates

- Young professionals

- Visiting lecturers & researchers

- Outsourcing firms

- Tech companies

- Start ups

- Training institutes

- Human resources firms

PROPERTY FEATURES

- High- speed internet

- Laundry facilities,

- Restaurants & Kitchens

- Well-lit common areas

- Secure access systems,

- CCTV and 24/7 monitoring

- Call centres communication tools

- Work stations

- Private offices

- Remote work capabilities

- Meeting rooms

PROPERTY FEATURES

- Solar electrification

- Energy efficient appliances

- Smart building technologies

- Ample living & study space

- Gym & sport facilities

- Social hubs & outdoor oasis

- Robust renewable energy system

- Innovative & collaborative space

- Events halls & Green space

- Training centre

- Access control

LOCATIONS

Property Locations

TEAM

Ed Nwokedi

Ed is the Founder and CEO of RedSwan CRE Marketplace (“RedSwan”). RedSwan is a leading commercial real estate platform for asset-backed securities, with over $9 billion in tokenized real estate assets. The platform is registered by the SEC and FINRA through its broker-dealer entity, RedSwan Markets, enabling legal issuance, sale, and trade of digital securities of commercial real estate shares.

Ed’s 23-year real estate journey includes tenure at Colliers International and Cushman and Wakefield, Texas, where he rose to Executive Director of Capital Markets, culminating in more than $2.7 billion in multifamily sales. He holds an M.B.A. from St. Mary’s College of California and a B.S. in Accounting and Organizational Behavior from the University of Michigan. Ed is also on the advisory board of the Bauer Real Estate Program at the University of Houston’s C.T. Bauer College of Business.

Dr. Don Oparah

Don has a PhD in IT from the University of Cambridge, UK, and is a TED speaker and Oxford University speaker on tech innovation. Don has over 20 years of experience in enterprise and startup technology, including being an early employee at publicly traded technology company Agilysys and later as Founder and Director of The Venture Accelerator at the University of California, Santa Barbara.

Don participated in launching over 20 startups in his career, many of which were successfully backed by leading venture funds, with several acquired by Fortune 500 companies.

Martha Theus

Martha brings over 40 years of experience in financial accounting, internal control, and compliance. She has held significant auditing roles, including working at Ernst & Young and serving as Corporate Internal Audit Manager at Lockheed Martin Corporation.

In the early 2000s, Martha transitioned to private practice, honing her expertise in real estate syndication, private placements, investor due diligence, cap table management for both sponsors and investors, and comprehensive financial and tax reporting. She has also been instrumental in implementing investment management software to ensure regulatory compliance with investor standards.

Martha graduated from the University of Michigan with a concentration in Accounting. She is a licensed CPA in California and holds FINRA Series 7, 14, 24, 27, 66 and 79 licenses.

Charles Smulevitz

Charles is an expert in the field of financial compliance, specializing in FINRA rules and regulations. Charles holds a Bachelor’s degree in Mathematics, which has provided him with a solid quantitative background that he skillfully applies to navigate the complexities of the financial industry, bringing analytical precision and a keen eye for detail to his work, ensuring that financial institutions adhere to the highest standards of regulatory compliance. Charles has over 15 years experience and holds numerous FINRA certifications including the Series 4, 7, 24, 28, 53, 55, 66, 79, 87 and 99.

Fatai Tunde Ogunwale

Fatai has over a decade experience in the Nigerian real estate market and a member of Nigerian Institution of Estate Surveyors and Valuers (NIESV). He has a Postgraduate degree in Data Science and Business analytics, McCombs Business School, Texas.

He will oversee the implementation and growth of RedSwan CRE’s operations in Nigeria. His local insights and expertise are crucial for navigating the regulatory landscape and fostering investor confidence.

Ticker Symbol:

Investment Opportunity

support@redswan.io